Contents

Jim Cramer’s Recent Stock Pick: CoreWeave Inc. and the AI Industry’s Growth Prospects

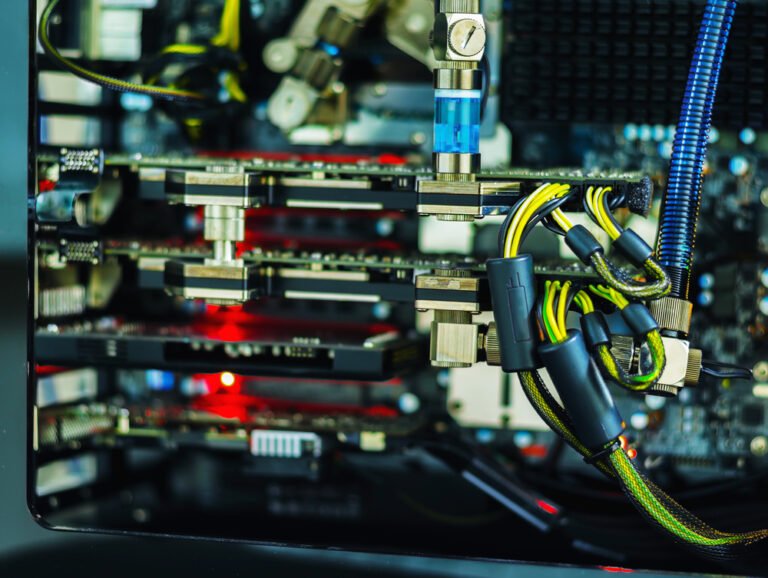

CoreWeave Inc. (NASDAQ:CRWV), a computing infrastructure provider catering to the AI industry, has been in the spotlight after Jim Cramer discussed its potential and announced a new deal with NVIDIA. This article explores Cramer’s views on CoreWeave, the company’s role in the AI ecosystem, and the potential for investors in the AI sector.

The recent discussion of CoreWeave Inc. (NASDAQ:CRWV) by Jim Cramer has brought attention to the company’s potential in the AI industry. As a computing infrastructure provider, CoreWeave plays a crucial role in supporting the needs of AI companies. Cramer, who was among the first to show enthusiasm for CoreWeave when it listed its shares earlier this year, has also cautioned viewers about the high share prices. The announcement of a new deal with NVIDIA, where the latter would purchase excess cloud computing capacity, has further highlighted CoreWeave’s position in the market. According to Cramer, “Take a look at CoreWeave, they announced a deal this morning. Boom, nine points. Somebody says, listen, that deal is real. Huge up.” This statement underscores the significance of the deal and its potential impact on CoreWeave’s stock performance.

The AI Industry’s Growth Prospects

The AI industry has been experiencing rapid growth, with companies like CoreWeave Inc. playing a vital role in providing the necessary infrastructure. The demand for AI computing power is increasing, driven by the adoption of AI technologies across various sectors. As a result, companies like CoreWeave are well-positioned to benefit from this trend. Some key highlights of the AI industry’s growth prospects include:

* Increasing demand for AI computing power

* Growing adoption of AI technologies across various sectors

* Rising investment in AI research and development

* Expanding applications of AI in industries like healthcare, finance, and transportation

Jim Cramer’s Views on CoreWeave Inc.

Jim Cramer’s comments on CoreWeave Inc. have been closely watched by investors and industry analysts. While he has expressed enthusiasm for the company’s potential, he has also warned about the high share prices. Cramer’s views on CoreWeave can be summarized as follows:

* Positive on the company’s potential in the AI industry

* Cautious about the high share prices

* Emphasizes the significance of the deal with NVIDIA

* Believes that some AI stocks hold greater promise for delivering higher returns with limited downside risk

Investment Opportunities in the AI Sector

The AI sector offers a range of investment opportunities, from established players to newer entrants like CoreWeave Inc. While CoreWeave has shown promise, some AI stocks may offer higher returns with limited downside risk. For investors looking for an extremely cheap AI stock that benefits from Trump tariffs and onshoring, there are alternative options available. Some key points to consider when investing in the AI sector include:

* Diversification: spreading investments across various AI stocks to minimize risk

* Research: conducting thorough research on the company’s financials, products, and market position

* Long-term perspective: taking a long-term view when investing in the AI sector, as the industry is expected to experience significant growth

Conclusion and Recommendations

In conclusion, CoreWeave Inc. (NASDAQ:CRWV) is a company with potential in the AI industry, and Jim Cramer’s comments have brought attention to its growth prospects. However, investors should be cautious about the high share prices and consider alternative AI stocks that may offer higher returns with limited downside risk. For those looking for an extremely cheap AI stock, there are options available that benefit from Trump tariffs and onshoring. As the AI industry continues to grow, it is essential for investors to stay informed and adapt to the changing landscape.

Conclusion: The AI industry’s growth prospects are promising, with companies like CoreWeave Inc. playing a vital role in providing the necessary infrastructure. While Jim Cramer’s comments on CoreWeave have been positive, investors should exercise caution and consider alternative AI stocks that may offer higher returns with limited downside risk. As the industry continues to evolve, it is crucial for investors to stay informed and adapt to the changing landscape.

Keywords: Jim Cramer, CoreWeave Inc., AI industry, computing infrastructure, NVIDIA, investment opportunities, AI stocks, Trump tariffs, onshoring, long-term perspective, diversification, research.

Hashtags: #JimCramer #CoreWeaveInc #AIIndustry #ComputingInfrastructure #NVIDIA #InvestmentOpportunities #AISTocks #TrumpTariffs #Onshoring #LongTermPerspective #Diversification #Research

Source link