, [Key points], Conclusion: [Closing paragraph], Keywords: [List], Hashtags: [List]. Rewrite the following content accordingly:

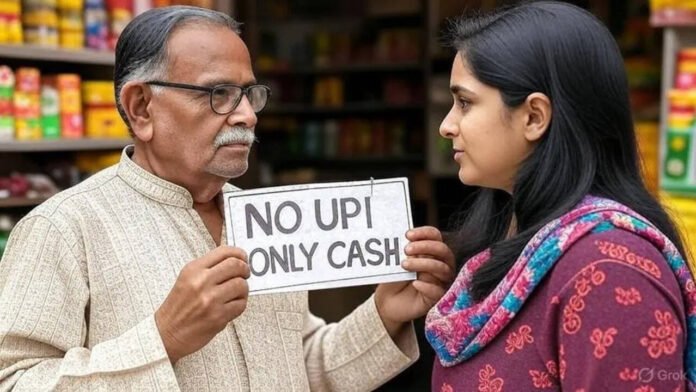

Why Bengaluru Shopkeepers Are Refusing Digital Payments (This is an AI-generated image)

Bengaluru, India’s IT hub, is refusing digital payments. Sounds a bit off, right? The city seems to be going back to the “cash only” option, shunning UPI payments, citing pressure from tax authorities. Several small vendors across the city have displayed stickers or boards saying, “No UPI, only cash.”

The trends follow after thousands of unregistered small businesses in Bengaluru, from street food vendors and pushcart sellers to corner shops, reportedly received GST notices, with some facing tax demands running into lakhs of rupees, according to vendors, lawyers, and accountants.

Vinay K Sreenivasa, advocate and joint secretary of the Federation of Bengaluru Street Vendors Associations, said the sudden notices have triggered widespread fear of harassment among vendors, a TOI report said. Many now worry about eviction by civic authorities and are increasingly opting for cash payments to avoid drawing attention.

Under the GST law, businesses selling goods must register and pay GST if their annual turnover exceeds Rs 40 lakh, while the threshold is Rs 20 lakh for service providers. The commercial taxes department has clarified that notices were issued only to those vendors whose UPI transaction data since FY 2021-22 suggested turnover levels beyond these limits. Officials maintain that such businesses are legally required to register, report their taxable income, and pay due GST.

However, HD Arun Kumar, former additional commissioner of commercial taxes in Karnataka, cautioned that tax authorities cannot assume turnover based solely on digital transactions. “GST authorities cannot simply quote random figures as turnover,” he noted, hinting at possible overreach.

“Under the GST laws, the burden of proof is on officers. They must establish it before arriving at a tax demand, unlike in money laundering cases,” he said.

Opposition BJP MLA S Suresh Kumar said he intends to write to Chief Minister Siddaramaiah, urging his intervention in the matter. Meanwhile, a former GST field official highlighted a key concern, noting, “Not all UPI credits indicate business income. Some may be informal loans or transfers from family and friends.”

Notably, Karnataka’s tax authorities are facing mounting pressure to achieve a revenue collection target of Rs 1.20 lakh crore for 2025–26. Chief Minister Siddaramaiah is caught between financing Rs 52,000 crore worth of welfare guarantees and addressing growing demands from Congress MLAs for increased infrastructure funding across the state.