Act as a senior journalist and professional content writer to write 1500+ words news article, SEO-optimized news article,, easy-to-understand news article. Begin with a compelling, keyword-rich title wrapped in an H1 HTML tag (

Contents

- 1 [Insert Title]

[Insert Title]

). Follow with a bolded one-paragraph summary wrapped in a div with the class name “yellowbg” (

[Insert Summary]

). Structure the article with an engaging lead paragraph that answers the 5 Ws and 1 H (Who, What, Where, When, Why, and How), followed by informative subheadings (use

for main subheadings and

for supporting subheadings). Include bullet points for key highlights, relevant quotes, and data where applicable. Use simple, clear language for broad accessibility. Conclude with a strong closing paragraph, a list of keyword-rich terms, and relevant hashtags. Ensure the content is well-structured, concise, and tailored for readability while maintaining a professional tone. Example format:

[Insert Title]

, Summary:

[Insert Summary]

, Lead: [Engaging opening answering 5 Ws and 1 H],

[Main Subheading]

, [Key points],

[Supporting Subheading]

, [Key points], Conclusion: [Closing paragraph], Keywords: [List], Hashtags: [List]. Rewrite the following content accordingly:

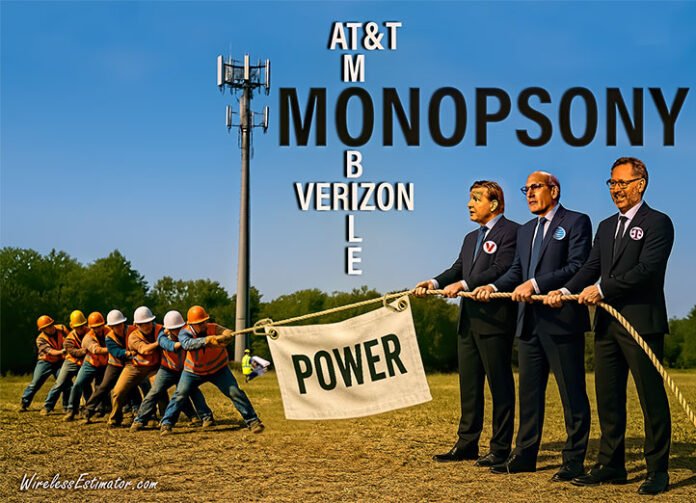

EASILY HOLDING ON TO POWER — “This BRATTLE GROUP REPORT should be mandatory reading in the C-suites of Verizon, T-Mobile, and AT&T,” said NATE President & CEO Todd Schlekeway. He explained it clearly validates what NATE’s member companies have long experienced on the ground: a market distorted by monopsony power, where the economic structure is broken and unsustainable. NATE, in a statement, said it will share these findings with key federal government agencies and congressional stakeholders in the coming weeks to continue educating policymakers and driving urgently needed reforms.

A new economic report by The Brattle Group warns of “market failure” in the U.S. wireless infrastructure services industry, citing the outsized buying power of the nation’s three largest wireless carriers.

Commissioned by NATE: The Communications Infrastructure Contractors Association, the report finds that Verizon, AT&T, and T-Mobile – which collectively control roughly 97% of the wireless market – wield monopsony power over hundreds of small contractors in the tower construction and maintenance sector.

Commissioned by NATE: The Communications Infrastructure Contractors Association, the report finds that Verizon, AT&T, and T-Mobile – which collectively control roughly 97% of the wireless market – wield monopsony power over hundreds of small contractors in the tower construction and maintenance sector.

This imbalance, the study suggests, has led to suppressed compensation, unsustainable contracting practices, and underinvestment in the specialized workforce that builds and repairs critical communications towers and associated infrastructure.

The result is a broken economic model that not only threatens the viability of contractor firms but also poses long-term risks to national security, public safety, and wireless innovation, according to the report’s findings.

Evidence of monopsony and key findings

Wireless contractors are being squeezed by rigid, take-it-or-leave-it pricing structures imposed by dominant carriers. The Brattle Group report confirms that a few buyers dominating a market of many sellers – a textbook monopsony – can dictate terms and suppress compensation across the supply chain.

The Brattle study bolsters its conclusions with extensive survey data from NATE member companies, painting a stark picture of skewed market dynamics. A Brattle Group representative who participated in the study, which began in March, said the response from 87 principal contractors was a “phenomenally good response rate.”

Report doesn’t undermine current NATE negotiations with carriers

During a conference call this afternoon with editors regarding the report, NATE executives emphasized that the carriers were aware that NATE had commissioned the Brattle Group to undertake the study since federal regulators, as well as carriers, had requested documentation of contractor allegations that current matrix pricing was unsustainable, had decreased dramatically over the years, and the industry was near collapse.

During a conference call this afternoon with editors regarding the report, NATE executives emphasized that the carriers were aware that NATE had commissioned the Brattle Group to undertake the study since federal regulators, as well as carriers, had requested documentation of contractor allegations that current matrix pricing was unsustainable, had decreased dramatically over the years, and the industry was near collapse.

It was noted that Verizon and T-Mobile have provided a framework agreement to assist contractors, and NATE is actively working with AT&T to reach an agreement that would also help struggling contractors. In addition, two carriers have adjusted their payment terms.

The Brattle Group’s extensive research capabilities, demonstrated in its white paper “Network Capacity Constraints and the Need for Spectrum” for CTIA, provided critical economic justification that bolstered the wireless industry’s case for expanded licensed spectrum access in federal policymaking.

NATE believes that this new report on monopsony in the wireless infrastructure sector will generate similar traction among policymakers, regulators, and lawmakers seeking to address market imbalances threatening network deployment and workforce sustainability.

Key findings from the report’s survey evidence include:

Inadequate Pricing: Over 80% of contractors say that the fixed “matrix pricing” schedules offered by the major carriers fail to cover even their basic operating costs. In parallel, 96% report that these one-size-fits-all contracts do not account for site-specific challenges – such as local labor rates, rugged terrain, or weather delays – which can significantly impact project costs.

This reflects what economists call a classic monopsony symptom, where a few dominant buyers (Verizon, AT&T, T-Mobile) suppress compensation levels in a market served by hundreds of specialized labor firms.

Shifting of Costs to Contractors: 89% of contractors have experienced rising expenses to manage customer-provided materials, like warehousing carrier-owned equipment

Nearly 98% are now required to pay for third-party compliance programs – vendor management systems, safety and training certifications, and other carrier-mandated platforms – out of their pocket.

Yet 97% of contractors receive no direct compensation from the carriers for these additional costs, which further erodes their margins.

Worsening Payment Terms: Between 13% and 41% of contractors report that late payments from the carriers have increased over the past three years

Standard payment cycles, which used to be 30 days, have stretched to 60, 90, or more days, and many contractors cite growing delays in getting paid for completed work. These extended payment terms, combined with new fees (some carriers require vendors to pay a percentage to use mandated invoice processing platforms), have forced contractors to float labor and material costs for more extended periods, straining small businesses’ cash flow.

“Take-It-Or-Leave-It” Contracts: The report characterizes the relationship as highly one-sided – a “take-it-or-leave-it” environment with limited room to negotiate.

In fact, only 7% of surveyed contractors working under a Verizon contract were able to negotiate better rates than the standard matrix pricing. The numbers were similarly low for T-Mobile (just 6%) and AT&T (16%).

In other words, over 90% of vendors could not influence the prices they are paid for tower work. This lack of bargaining ability underscores the power imbalance: carriers set the terms unilaterally, and contractors must accept or lose the work.

Declining Profitability: 84% of contractors say their gross profit margins have deteriorated over the last three years

Many report operating on razor-thin margins – or at a loss – simply to stay in business and retain skilled employees.

The Brattle analysts note that carrier “matrix” price lists often remained flat or even saw reductions in unit prices in recent contract updates, despite inflation and higher costs for contractors.

This margin squeeze has made it difficult for reputable contractors to invest in training, safety, and quality, and reward skilled tower technicians.

The cumulative picture is one of contractors being systematically squeezed; higher costs are shifted onto them, payments are delayed, and non-negotiable rates constrain compensation. According to the Brattle Group, these conditions indicate a market failure driven by monopsony power – in essence, the Big 3 carriers leveraging their dominant-buyer status to dictate economic terms in a manner that a truly competitive market would not sustain.

The report’s authors note that while the national carriers have benefited from outsourcing (avoiding the capital expense of building and maintaining towers themselves and managing the installation and maintenance of their sites), they have used their leverage to impose contract conditions that are “unsustainable” for the service providers in the long run.

Contractors under Strain: An Unsustainable Model

The economic pressure on contractors revealed by the study is already having real-world consequences. The Brattle report highlights a contracting industry: 54% of surveyed contractor firms have reduced their employee counts over the last three years, and there is evidence that many experienced firms are exiting the business altogether.

NATE members describe a climate in which even long-standing, reputable tower service companies are struggling to survive under current conditions. To maintain critical workforce capabilities, some contractors have been accepting projects at a loss – essentially subsidizing the carriers – in hopes of staying afloat and keeping their highly trained crews employed.

This pattern is, in the report’s words, “already leading to harmful consequences for both the labor market and national security.”

As qualified contractors scale back or shut down, veteran tower climbers and technicians are leaving the industry, taking with them decades of hard-earned expertise.

The survey data indicates a significant loss of “institutional knowledge” – the specialized skills and tacit know-how required to build and maintain complex wireless infrastructure safely and efficiently.

Industry observers warn that if this trend continues, it could result in a shortage of reliable contractors and a brain drain in the tower climbing workforce, just as demand for upgrades (like 5G deployments and beyond) continues to grow. NATE and other stakeholders have voiced concern that the void is sometimes filled by lower-tier subcontractors or unvetted crews, which can compromise safety and quality.

In an open letter earlier this year, NATE warned that “fly-by-night” contractors with poorly trained workers were entering the market with rock-bottom bids, undercutting standards and posing risks to network integrity.

The new Brattle report suggests that this outcome is a direct result of economic distortions: when fair compensation is suppressed, the industry fails to attract and retain the high-skill labor needed, potentially allowing less-qualified providers to proliferate.

National Security, Public Safety, and Innovation at Risk

Beyond the immediate business impacts, the report underscores that the stakes extend to national security and public safety if the current market trajectory is not corrected. Communications infrastructure is classified as critical national infrastructure, and tower crews are the frontline in keeping wireless networks operational during disasters, emergencies, and day-to-day operations. The loss of experienced tower climbers is not just a labor market concern – it is a national security issue, the report emphatically states.

A shrinking, demoralized workforce in this sector means reduced readiness to respond to natural disasters or large-scale outages/attacks, and slower deployment of advanced wireless capabilities that the economy increasingly relies on

“The communications sector is a critical infrastructure industry, and disruptions in this market threaten public safety and economic growth,” the Brattle report explains, noting that the industry is “already losing this workforce due to unsustainable economic conditions.”

Over half of contractors have already downsized their staff, a “deeply experienced labor force” that cannot be easily replaced once lost.

This dwindling of skilled technicians and crew leads to an erosion of institutional knowledge, which “dulls the industry’s capacity to adapt quickly to future infrastructure needs.”

Furthermore, the study identifies a classic positive externality problem at play. A robust, skilled tower workforce provides broad public benefits – enhanced safety, security, and innovation capacity for the country – that go beyond the immediate interests of the carriers.

However, because the Big 3 carriers focus on minimizing their costs, they are underinvesting in this critical labor force from society’s perspective

In economic terms, the carriers do not fully internalize the costs of depleting the skilled labor pool (since the societal damage from a weakened communications infrastructure – e.g. during emergencies – isn’t reflected on their balance sheets).

This misalignment between private incentives and public interest is the second facet of the market failure identified in the report. “The national security impacts of the wireless infrastructure workforce are a classic example of a positive externality underinvested in by private actors,” the authors write, warning that if the industry’s expertise is lost, “it cannot be easily regenerated when the need inevitably arises.”

[Insert Title]

[Insert Summary]

EASILY HOLDING ON TO POWER — “This BRATTLE GROUP REPORT should be mandatory reading in the C-suites of Verizon, T-Mobile, and AT&T,” said NATE President & CEO Todd Schlekeway. He explained it clearly validates what NATE’s member companies have long experienced on the ground: a market distorted by monopsony power, where the economic structure is broken and unsustainable. NATE, in a statement, said it will share these findings with key federal government agencies and congressional stakeholders in the coming weeks to continue educating policymakers and driving urgently needed reforms.

A new economic report by The Brattle Group warns of “market failure” in the U.S. wireless infrastructure services industry, citing the outsized buying power of the nation’s three largest wireless carriers.

Commissioned by NATE: The Communications Infrastructure Contractors Association, the report finds that Verizon, AT&T, and T-Mobile – which collectively control roughly 97% of the wireless market – wield monopsony power over hundreds of small contractors in the tower construction and maintenance sector.

Commissioned by NATE: The Communications Infrastructure Contractors Association, the report finds that Verizon, AT&T, and T-Mobile – which collectively control roughly 97% of the wireless market – wield monopsony power over hundreds of small contractors in the tower construction and maintenance sector.

This imbalance, the study suggests, has led to suppressed compensation, unsustainable contracting practices, and underinvestment in the specialized workforce that builds and repairs critical communications towers and associated infrastructure.

The result is a broken economic model that not only threatens the viability of contractor firms but also poses long-term risks to national security, public safety, and wireless innovation, according to the report’s findings.

Evidence of monopsony and key findings

Wireless contractors are being squeezed by rigid, take-it-or-leave-it pricing structures imposed by dominant carriers. The Brattle Group report confirms that a few buyers dominating a market of many sellers – a textbook monopsony – can dictate terms and suppress compensation across the supply chain.

The Brattle study bolsters its conclusions with extensive survey data from NATE member companies, painting a stark picture of skewed market dynamics. A Brattle Group representative who participated in the study, which began in March, said the response from 87 principal contractors was a “phenomenally good response rate.”

Report doesn’t undermine current NATE negotiations with carriers

During a conference call this afternoon with editors regarding the report, NATE executives emphasized that the carriers were aware that NATE had commissioned the Brattle Group to undertake the study since federal regulators, as well as carriers, had requested documentation of contractor allegations that current matrix pricing was unsustainable, had decreased dramatically over the years, and the industry was near collapse.

During a conference call this afternoon with editors regarding the report, NATE executives emphasized that the carriers were aware that NATE had commissioned the Brattle Group to undertake the study since federal regulators, as well as carriers, had requested documentation of contractor allegations that current matrix pricing was unsustainable, had decreased dramatically over the years, and the industry was near collapse.

It was noted that Verizon and T-Mobile have provided a framework agreement to assist contractors, and NATE is actively working with AT&T to reach an agreement that would also help struggling contractors. In addition, two carriers have adjusted their payment terms.

The Brattle Group’s extensive research capabilities, demonstrated in its white paper “Network Capacity Constraints and the Need for Spectrum” for CTIA, provided critical economic justification that bolstered the wireless industry’s case for expanded licensed spectrum access in federal policymaking.

NATE believes that this new report on monopsony in the wireless infrastructure sector will generate similar traction among policymakers, regulators, and lawmakers seeking to address market imbalances threatening network deployment and workforce sustainability.

Key findings from the report’s survey evidence include:

Inadequate Pricing: Over 80% of contractors say that the fixed “matrix pricing” schedules offered by the major carriers fail to cover even their basic operating costs. In parallel, 96% report that these one-size-fits-all contracts do not account for site-specific challenges – such as local labor rates, rugged terrain, or weather delays – which can significantly impact project costs.

This reflects what economists call a classic monopsony symptom, where a few dominant buyers (Verizon, AT&T, T-Mobile) suppress compensation levels in a market served by hundreds of specialized labor firms.

Shifting of Costs to Contractors: 89% of contractors have experienced rising expenses to manage customer-provided materials, like warehousing carrier-owned equipment

Nearly 98% are now required to pay for third-party compliance programs – vendor management systems, safety and training certifications, and other carrier-mandated platforms – out of their pocket.

Yet 97% of contractors receive no direct compensation from the carriers for these additional costs, which further erodes their margins.

Worsening Payment Terms: Between 13% and 41% of contractors report that late payments from the carriers have increased over the past three years

Standard payment cycles, which used to be 30 days, have stretched to 60, 90, or more days, and many contractors cite growing delays in getting paid for completed work. These extended payment terms, combined with new fees (some carriers require vendors to pay a percentage to use mandated invoice processing platforms), have forced contractors to float labor and material costs for more extended periods, straining small businesses’ cash flow.

“Take-It-Or-Leave-It” Contracts: The report characterizes the relationship as highly one-sided – a “take-it-or-leave-it” environment with limited room to negotiate.

In fact, only 7% of surveyed contractors working under a Verizon contract were able to negotiate better rates than the standard matrix pricing. The numbers were similarly low for T-Mobile (just 6%) and AT&T (16%).

In other words, over 90% of vendors could not influence the prices they are paid for tower work. This lack of bargaining ability underscores the power imbalance: carriers set the terms unilaterally, and contractors must accept or lose the work.

Declining Profitability: 84% of contractors say their gross profit margins have deteriorated over the last three years

Many report operating on razor-thin margins – or at a loss – simply to stay in business and retain skilled employees.

The Brattle analysts note that carrier “matrix” price lists often remained flat or even saw reductions in unit prices in recent contract updates, despite inflation and higher costs for contractors.

This margin squeeze has made it difficult for reputable contractors to invest in training, safety, and quality, and reward skilled tower technicians.

The cumulative picture is one of contractors being systematically squeezed; higher costs are shifted onto them, payments are delayed, and non-negotiable rates constrain compensation. According to the Brattle Group, these conditions indicate a market failure driven by monopsony power – in essence, the Big 3 carriers leveraging their dominant-buyer status to dictate economic terms in a manner that a truly competitive market would not sustain.

The report’s authors note that while the national carriers have benefited from outsourcing (avoiding the capital expense of building and maintaining towers themselves and managing the installation and maintenance of their sites), they have used their leverage to impose contract conditions that are “unsustainable” for the service providers in the long run.

Contractors under Strain: An Unsustainable Model

The economic pressure on contractors revealed by the study is already having real-world consequences. The Brattle report highlights a contracting industry: 54% of surveyed contractor firms have reduced their employee counts over the last three years, and there is evidence that many experienced firms are exiting the business altogether.

NATE members describe a climate in which even long-standing, reputable tower service companies are struggling to survive under current conditions. To maintain critical workforce capabilities, some contractors have been accepting projects at a loss – essentially subsidizing the carriers – in hopes of staying afloat and keeping their highly trained crews employed.

This pattern is, in the report’s words, “already leading to harmful consequences for both the labor market and national security.”

As qualified contractors scale back or shut down, veteran tower climbers and technicians are leaving the industry, taking with them decades of hard-earned expertise.

The survey data indicates a significant loss of “institutional knowledge” – the specialized skills and tacit know-how required to build and maintain complex wireless infrastructure safely and efficiently.

Industry observers warn that if this trend continues, it could result in a shortage of reliable contractors and a brain drain in the tower climbing workforce, just as demand for upgrades (like 5G deployments and beyond) continues to grow. NATE and other stakeholders have voiced concern that the void is sometimes filled by lower-tier subcontractors or unvetted crews, which can compromise safety and quality.

In an open letter earlier this year, NATE warned that “fly-by-night” contractors with poorly trained workers were entering the market with rock-bottom bids, undercutting standards and posing risks to network integrity.

The new Brattle report suggests that this outcome is a direct result of economic distortions: when fair compensation is suppressed, the industry fails to attract and retain the high-skill labor needed, potentially allowing less-qualified providers to proliferate.

National Security, Public Safety, and Innovation at Risk

Beyond the immediate business impacts, the report underscores that the stakes extend to national security and public safety if the current market trajectory is not corrected. Communications infrastructure is classified as critical national infrastructure, and tower crews are the frontline in keeping wireless networks operational during disasters, emergencies, and day-to-day operations. The loss of experienced tower climbers is not just a labor market concern – it is a national security issue, the report emphatically states.

A shrinking, demoralized workforce in this sector means reduced readiness to respond to natural disasters or large-scale outages/attacks, and slower deployment of advanced wireless capabilities that the economy increasingly relies on

“The communications sector is a critical infrastructure industry, and disruptions in this market threaten public safety and economic growth,” the Brattle report explains, noting that the industry is “already losing this workforce due to unsustainable economic conditions.”

Over half of contractors have already downsized their staff, a “deeply experienced labor force” that cannot be easily replaced once lost.

This dwindling of skilled technicians and crew leads to an erosion of institutional knowledge, which “dulls the industry’s capacity to adapt quickly to future infrastructure needs.”

Furthermore, the study identifies a classic positive externality problem at play. A robust, skilled tower workforce provides broad public benefits – enhanced safety, security, and innovation capacity for the country – that go beyond the immediate interests of the carriers.

However, because the Big 3 carriers focus on minimizing their costs, they are underinvesting in this critical labor force from society’s perspective

In economic terms, the carriers do not fully internalize the costs of depleting the skilled labor pool (since the societal damage from a weakened communications infrastructure – e.g. during emergencies – isn’t reflected on their balance sheets).

This misalignment between private incentives and public interest is the second facet of the market failure identified in the report. “The national security impacts of the wireless infrastructure workforce are a classic example of a positive externality underinvested in by private actors,” the authors write, warning that if the industry’s expertise is lost, “it cannot be easily regenerated when the need inevitably arises.”