Oracle Stock Faces Short-Term Challenges But Long-Term Growth Potential Remains Strong

Oracle (NYSE: ORCL) has delivered notable gains for investors, but recent quarterly results have raised concerns. Despite short-term setbacks, the company’s strong position in the cloud infrastructure market presents significant long-term growth opportunities.

Oracle, a leading provider of database management and cloud services, has seen its stock price drop by 7% in 2025, a trend mirrored by the Nasdaq Composite. The decline follows disappointing earnings results for the third quarter of fiscal 2025, which ended on February 28, 2025. While Oracle has historically outperformed the Nasdaq with a remarkable 230% gain over the last five years, many investors are concerned about the company’s growth trajectory in the current market climate.

Recent Earnings Report: What You Need to Know

- Revenue increased by only 8% year-over-year, falling short of Wall Street expectations.

- Adjusted earnings jumped 4%, but were also below consensus estimates.

- Management has forecasted a revenue growth of 9% for the current quarter, below the 11% anticipated by analysts.

Market Reaction to Oracle’s Earnings

Following the earnings announcement on March 10, the stock experienced a temporary decline, emphasizing the anxieties surrounding Oracle’s short-term performance. A rapid response from investors suggests a strong focus on quarterly performance rather than long-term potential. However, analysts warn that this approach may overlook the company’s promising prospects.

Long-Term Prospects: Cloud Infrastructure and AI

Despite recent struggles, Oracle’s future looks bright, primarily due to its significant investments in cloud infrastructure. Management stated during the earnings call that Oracle’s capacity for cloud services is expanding rapidly:

- Remaining performance obligations (RPO)—the total value of unfulfilled contracts—rose by 62% year-over-year, reaching $130 billion.

- Last quarter, Oracle secured $48 billion in new contracts, marking their strongest quarter for bookings.

- Demand for cloud infrastructure, particularly for AI training, is outpacing supply, indicating strong future growth potential.

Market Forecast for Oracle

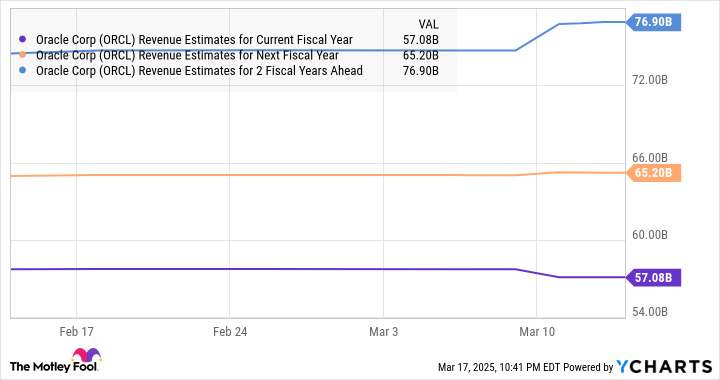

Goldman Sachs predicts the cloud infrastructure-as-a-service (IaaS) market could generate annual revenues of $580 billion by 2030. Oracle is positioning itself to capitalize on this growth:

- Revenue growth is expected to soar to 15% in fiscal 2026 and 20% in fiscal 2027.

- If these projections hold, Oracle’s revenue could surpass $79 billion by fiscal 2027.

Investors’ Outlook and Recommendations

As Oracle ramps up its data center capacity—doubling this fiscal year and aiming to triple it by next year—analysts suggest that its revenue growth rate will improve significantly. Management’s guidance indicates potential annual earnings growth of over 20% through fiscal 2029. If the company manages a growth rate of 25%, its earnings per share could reach $18.31 by fiscal 2030, showcasing strong returns for investors.

With Oracle currently trading at 21 times forward earnings, compared to the Nasdaq-100’s 25 times, investors may consider this an opportune moment to invest in a company poised for significant growth in the evolving tech landscape.

Conclusion

Despite recent setbacks and market volatility, Oracle’s long-term growth potential in cloud infrastructure and artificial intelligence presents a compelling opportunity for investors. How investors react in the coming months will likely shape the company’s next chapter.

Keywords: Oracle stock, cloud infrastructure, AI growth, Nasdaq performance, earnings report, long-term growth potential

Hashtags: #Oracle #StockMarket #Investment #CloudComputing #ArtificialIntelligence