Contents

Nvidia’s GTC Keynote: Analysts Weigh In on AI Innovations and Stock Performance

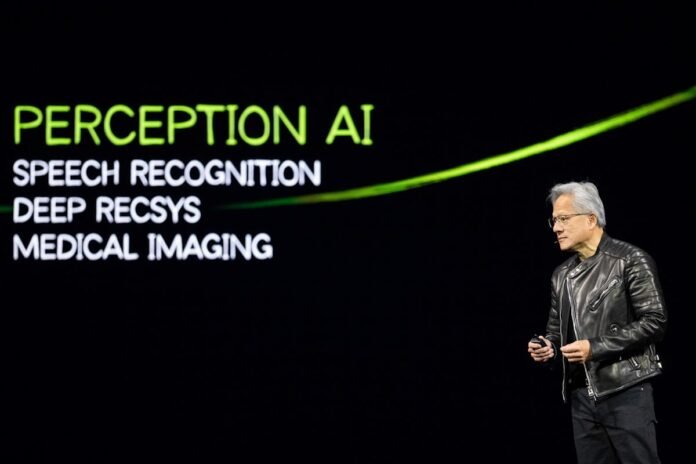

Nvidia’s recent GTC keynote, featuring CEO Jensen Huang, showcased the launch of powerful new AI chips and ambitious revenue projections, but Wall Street analysts remain cautious about the stock’s immediate potential.

Nvidia’s annual developer event took place recently, leaving investors and analysts buzzing with mixed reactions. The spotlight was on CEO Jensen Huang, who delivered a keynote packed with announcements about Nvidia’s latest advancements in artificial intelligence (AI) technology. While some celebrated the innovations, many on Wall Street are still searching for the catalysts necessary to drive the stock higher.

The Key Announcements

- Nvidia introduced powerful new AI chips, including the Blackwell Ultra and Vera Rubin, positioning the company at the forefront of AI development.

- Huang predicted that Nvidia’s data center revenue could reach a staggering $1 trillion by 2028, reflecting the company’s significant growth potential in the AI sector.

- The keynote also touched on new software innovations, such as Dynamo, which is designed to optimize reasoning models in data centers.

Reactions from Wall Street

- Despite the excitement over new AI technologies, Nvidia’s stock closed down 3.4% on the day of the keynote.

- Year-to-date, Nvidia’s shares are down 14%, as analysts evaluate the company’s pace of future growth amidst a competitive market.

- Many analysts left their price targets and ratings unchanged, indicating a cautious approach in light of the expected innovations.

Benchmark analyst Cody Acree noted that the keynote offered “incremental details,” suggesting that traders were expecting more immediate excitement rather than long-term visions. Conversely, Wedbush analyst Dan Ives praised Huang’s presentation, giving it an “A+” rating for its ambitious AI vision.

Market Implications

- Investors seem divided, with some confident in Nvidia’s long-term strategies, while traders focus on short-term performance.

- Nvidia’s recent presentations may reinforce the company’s leadership in AI, but analysts are questioning whether these advancements will translate to quick stock gains.

- Market watchers are keeping an eye on upcoming Nvidia products and market conditions to gauge future growth opportunities.

In conclusion, while Nvidia’s GTC keynote showcased impressive technology and vast revenue potential, the immediate reaction from Wall Street has been tepid. As analysts continue to dissect the implications of the announcements, investors are left weighing the long-term vision against the current stock market realities.

Keywords: Nvidia, GTC keynote, Jensen Huang, stock performance, AI innovations, Wall Street, data centers, Blackwell Ultra, Vera Rubin, Dynamo, future growth

Hashtags: #Nvidia #ArtificialIntelligence #StockMarket #Technology #Innovation #DataCenter